2023 marks a unique period for those seeking an Executive Condominium (EC) in Singapore, with a blend of public and private housing features. Prospective EC buyers must navigate the changing landscape, which includes understanding eligibility criteria, adhering to regulatory ratios like TDSR and MSR, and comparing various financing options including HDB loans and bank loans with competitive interest rates. It's essential to monitor your financial health, save diligently, and consider a savings buffer for unforeseen expenses post-purchase. Staying updated on market trends is vital as they influence monthly payments, making the expertise of an EC mortgage broker invaluable for securing favorable terms. By leveraging government initiatives like the CPF Housing Grant for ECs and strategic financial planning, buyers can make informed decisions to ensure their investment aligns with the dynamic EC market in Singapore for 2023 and beyond.

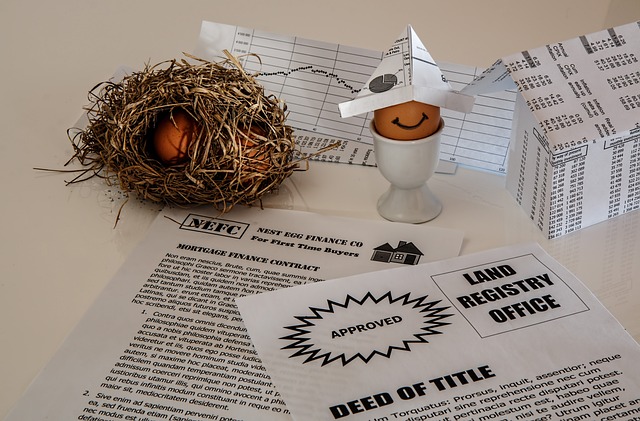

2023 presents a dynamic landscape for Executive Condominium (EC) ownership in Singapore, where understanding downpayment requirements and mortgage options is paramount. This article delves into the essential factors and strategic savings approaches tailored for ECs this year. From grasping the EC downpayment scene to exploring diverse home loans catering to new ECs, readers will navigate the path to securing an EC mortgage with confidence. We’ll guide you through the process, culminating in expert advice from seasoned homeowners. Whether you’re a first-time buyer or considering an upgrade, this comprehensive guide is your key to unlocking the home of your dreams within the vibrant EC Singapore 2023 market.

- Understanding the EC Downpayment Landscape in EC Singapore 2023

- Key Factors to Consider Before Applying for an EC Mortgage in Singapore

- Navigating Your Options: Types of Home Loans Available for New ECs

- Budgeting for Your EC Downpayment: Strategies and Saving Tips

- The Step-by-Step Process of Obtaining an EC Mortgage in 2023

- Maximising Your Financing Options: Advice from Experienced Homeowners in Singapore

Understanding the EC Downpayment Landscape in EC Singapore 2023

In 2023, the Executive Condominium (EC) landscape in Singapore continues to evolve, offering a myriad of options for both first-time homeowners and upgraders. Prospective buyers seeking an EC downpayment must navigate the specific financial requirements set forth by the government. The downpayment for an EC varies depending on the mortgage loan terms secured; typically, it is 5% to 25% of the purchase price. To finance this initial outlay, a combination of savings, CPF (Central Provident Fund) funds, and housing loans can be utilized. Understanding the interplay between these components is crucial for a smooth transaction. The Singaporean government has measures in place to ensure that ECs remain accessible without leading to over-leveraging. These measures include limiting loan-to-value (LTV) ratios and loan tenures, which influence the total cost of ownership and affordability.

For buyers in 2023, it is imperative to stay informed about the prevailing EC policies, as they can significantly impact your repayment schedule and long-term financial commitments. The EC downpayment is just the beginning; understanding the subsequent mortgage terms, including the total debt servicing ratio (TDSR) and mortgage service ratio (MSR), will guide you in selecting an appropriate loan structure. These financial prudence rules are designed to ensure sustainable home ownership. As such, potential EC owners should engage with financial advisors and review their financial planning to align with these regulations. By doing so, they can take advantage of the benefits that ECs offer while maintaining a healthy financial standing.

Key Factors to Consider Before Applying for an EC Mortgage in Singapore

2023 presents a unique landscape for Executives’ Condominium (EC) mortgage applicants in Singapore. Prospective homeowners should meticulously evaluate their financial readiness before applying for an EC mortgage. Key considerations include assessing your debt-to-income ratio, which reflects the proportion of your monthly income that goes towards debt repayment. This ratio is crucial as it informs lenders about your ability to manage new loan obligations alongside existing financial commitments. Additionally, future financial stability should be a priority; ensure you have a buffer for unforeseen expenses or economic shifts that may affect your income.

Another significant factor is the total cost of ownership, which extends beyond the mortgage repayment itself. It encompasses maintenance fees, additional buyer’s stamp duty (ABSD), and other related costs. For instance, the ABSD for Singaporean couples buying their first EC in 2023 is 5%. Also, be mindful of the Mortgage Servicing Ratio (MSR) cap in Singapore, which stipulates that monthly housing loan installments should not exceed 30% of a borrower’s monthly income. By carefully considering these elements and staying updated with EC Singapore 2023 policies and market trends, you can make informed decisions and secure a mortgage that aligns with your long-term financial goals.

Navigating Your Options: Types of Home Loans Available for New ECs

When considering the purchase of a new Executive Condominium (EC) in Singapore for 2023, understanding the various home loan options available is crucial for a sound financial decision. Prospective homeowners can explore several types of housing loans tailored to their needs and financial capabilities. The Housing & Development Board (HDB) offers the Fixed-Rate Scheme (FRS), which allows buyers to lock in an interest rate for a set period, providing stability in loan repayments. Another option is the Market Rate Option (MRO), where borrowers choose variable rates that may offer lower initial interest rates but come with the volatility of market fluctuations.

In addition to these, financial institutions provide their own packages, often including packages for ECs under the Singapore government’s concessionary loan schemes like the Concessionary Grant Loan (CGL) for ECs. These loans are designed to assist with the downpayment and later the stepping-up of loan quantum after the EC reaches the 5-year mark post-completion, reflecting the value appreciation of such properties. Prospective buyers should also consider the Total Debt Servicing Ratio (TDSR) framework and the Mortgage Servicing Ratio (MSR) to ensure their monthly commitments remain sustainable against their income. For the most updated information and eligibility criteria, it’s advisable to consult the official resources or a financial adviser specializing in property financing.

Budgeting for Your EC Downpayment: Strategies and Saving Tips

When planning for your Executive Condominium (EC) downpayment in Singapore, particularly in 2023, it’s crucial to adopt a strategic approach to saving and budgeting. The EC Singapore 2023 market presents unique opportunities and challenges for prospective homeowners. To effectively save for your EC downpayment, start by assessing your current financial situation, including your income, expenses, and any savings you have. Create a detailed budget that accounts for all sources of income and every conceivable expenditure to free up as much funds as possible for your EC purchase.

Consider setting up a dedicated savings account specifically for your EC downpayment. This approach allows you to track your progress and remain focused on your goal. Additionally, explore various saving strategies such as the “50-30-20” rule, where 50% of your income covers necessities, 30% goes towards lifestyle choices, and 20% is allocated to savings and investments. Take advantage of government schemes like the CPF (Central Provident Fund) Housing Grant for ECs, which can significantly reduce the amount you need to save. Furthermore, staying informed about the latest financial products and interest rates can help optimize your savings, ensuring that your funds grow effectively while you work towards the EC Singapore 2023 of your choice.

The Step-by-Step Process of Obtaining an EC Mortgage in 2023

In 2023, obtaining an Executive Condominium (EC) mortgage in Singapore is a structured process designed to guide eligible applicants through the financial commitment of purchasing an EC. Prospective homeowners should begin by assessing their eligibility criteria set forth by the Housing & Development Board (HDB), which includes income ceiling requirements and the Total Debt Servicing Ratio (TDSR) framework to ensure that applicants can manage their monthly mortgage repayments comfortably. The first step involves securing an HDB loan, which can finance up to 75% to 85% of the purchase price or valuation of the EC, whichever is lower. Next, individuals should explore additional financing from financial institutions for the remaining percentage.

Once the eligibility and financial assessment are complete, applicants proceed to select an EC unit through the Sales of Flat (SOF) portal. It’s crucial to consider the EC’s location, size, and pricing to make an informed decision that aligns with your needs and financial capacity. After successful booking and option application, potential buyers engage a bank or financial institution to apply for the mortgage loan. The financial institution will evaluate credit history, income stability, and existing obligations to determine the loan-to-value (LTV) ratio and interest rates. In 2023, EC homeowners benefit from various loan packages offered by banks in Singapore, which may include attractive interest rate options and flexible repayment tenures. Throughout this process, applicants must maintain transparency with their financial institutions to ensure a smooth application and approval for their EC mortgage.

Maximising Your Financing Options: Advice from Experienced Homeowners in Singapore

In the dynamic property market of Singapore, understanding and maximizing your financing options is key to securing a home that aligns with your long-term financial goals. Experienced homeowners often emphasize the importance of early planning when considering an EC (Executive Condominium) downpayment and mortgage. The EC scheme in Singapore, particularly in 2023, offers a unique hybrid of public and private housing benefits for eligible applicants. Prospective buyers should explore various financing avenues, including bank loans, HDB loans, and CPF (Central Provident Fund) utilization. It’s advantageous to compare the interest rates, loan-to-value ratios, and repayment tenors across different financial institutions. Furthermore, taking cues from seasoned homeowners, it’s prudent to maintain a buffer savings for unforeseen expenses post-purchase. This foresight not only safeguards your finances but also positions you favorably for potential refinancing opportunities down the line.

Another strategic approach is to monitor market trends and interest rate movements throughout the year, as these factors can significantly impact your monthly payments and overall financial commitment. Homeowners with firsthand experience often highlight the value of engaging a mortgage broker who can provide tailored advice based on your unique financial situation. These professionals are well-versed in navigating the nuances of EC financing and can assist you in optimizing your mortgage terms for better financial outcomes. By leveraging their expertise, you can make informed decisions that align with your financial objectives, ensuring that your investment in an EC is both responsible and rewarding in 2023 and beyond.

navigating the EC downpayment and mortgage landscape in Singapore for 2023 requires careful planning and a thorough understanding of the available options. This article has outlined the essential considerations for potential EC homeowners, from budgeting strategies to the types of home loans suited for new Executive Condominium (EC) units. By taking into account the unique financial landscape and the various mortgage products available, prospective buyers can make informed decisions that align with their long-term financial goals. With the tips and insights provided from industry veterans, readers are now equipped with a roadmap to successfully secure an EC mortgage and manage their downpayment effectively. As the real estate market in Singapore continues to evolve, the guidance offered here remains a valuable resource for those looking to invest in an EC this year.